Regardless of the size of the organization, it’s no secret that every “buck” stops on the CEO’s desk and trust is no exception. A CEO who fails to “model” trust cannot build or maintain a sustainable business. So while the following “10 T’s of Trustworthy Leadership” may seem somewhat obvious to you, they may not be to your CEO. Share them the next time your team meets and deliver a copy of this blog to the CEO’s office. If he or she doesn’t thank you for it, you’re probably working for the wrong leader.

#1 Trustworthy- Very simply, a culture of trust cannot exist with an untrustworthy leader. Trustworthy behavior must start at the top and flow down through every manager within the organization. Trust building tools should be incorporated into meetings. Management should reward those who model trust and CEO’s should regularly address all stakeholders about the steps being taken to build trustworthy behavior within the organization.

#2 Tools- and speaking of tools, there are many trust tools that CEO’s can utilize to build trust amongst their internal and external stakeholders. They run the gamut from metrics to assessments and online surveys. The results may be surprisingly good, or just the opposite. And if they are the latter, it’s time to get busy. Either way, maybe it’s time to add a Chief Trust Officer to the staff. And remember, what can be measured can be managed.

#3 Treatment- The Golden Rule says to “treat others the way you want to be treated” and certainly holds true with trust. The CEO that extends trust to his/her stakeholders is more likely to have it returned.

#4 Teamwork- As we all know, teamwork leads to better decisions and better outcomes. Breaking down the silos to make trustworthy behavior the #1 priority in the C-Suite, should be on every CEO’s “to do” list. Trust should not be confused with compliance. Being “legal” is not the same as being trustworthy.

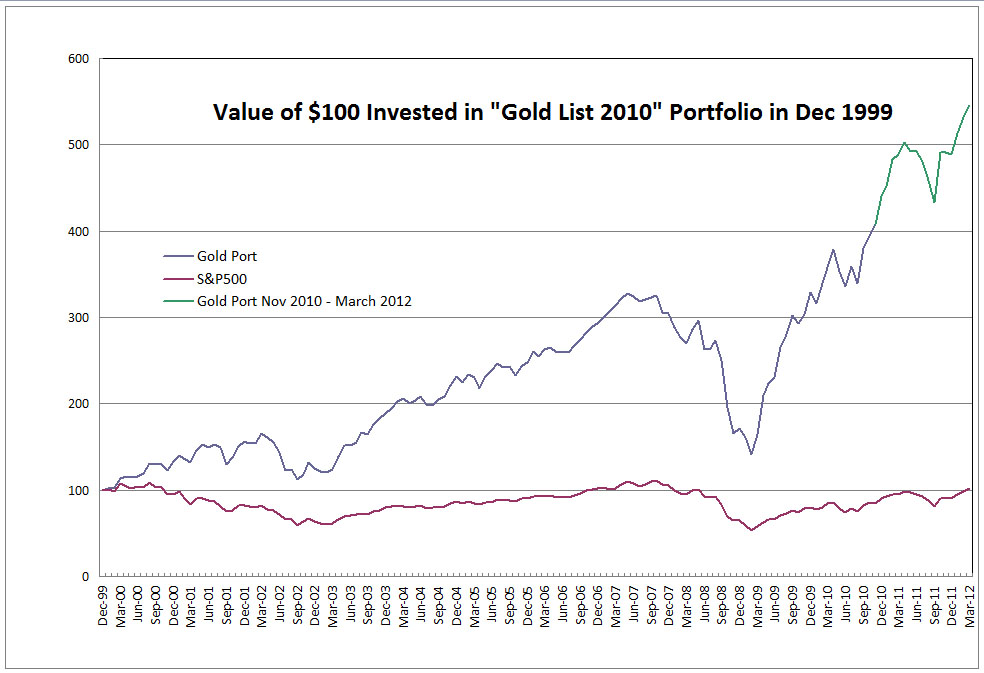

#5 Talk- Your stakeholders need to know what steps you are taking to build a trustworthy organization. Let’s face facts, quarterly numbers are no longer the “be all and end all,” and the evidence is building that one need not sacrifice “good numbers” for a trustworthy culture. Companies can simultaneously “do good and do well. “ www.trustacrossamerica.com/blog/?p=573

#6 Truth- for goodness sake, any CEO who wants to build a trustworthy organization, must always tell the truth. No company is perfect. It’s not necessary to air all the dirty laundry, just don’t lie about it.

#7 Time- Building a culture of trustworthy business does not happen overnight. It takes time, maybe even years. The CEO who invests the time to educate himself or herself about how to build trust among teams and with stakeholders, develops a plan, communicates and implements it, will be rewarded with greater stakeholder trust. And when the slip up occurs, those who “banked” trust will recover faster.

#8 Transparency- Merriam Webster defines “transparent” as characterized by visibility or accessibility of information especially concerning business practices. Any CEO who thinks he/or she can still hide behind a veil of secrecy need only spend a few minutes on the social networks reading what stakeholders are saying about his/her company. Why not be proactive? It’s time to stop viewing transparency as a risk.

#9 Thoughtful- that’s not to say that stakeholders must know the company’s trade secrets or what the CEO had for dinner. But the CEO who thinks about building a trustworthy organization, might consider making “trust” more prominent through a well-developed communications strategy. It’s still the rare company that makes trust a priority, so if yours is one of the few that do, why not brag about it? Your stakeholders will thank you for it.

#10 Tweet- If Bill George sees a reason to do it, it’s probably time you did too!

online.wsj.com/article/SB10000872396390444083304578018423363962886.html?mod=rss_Technology

Barbara Kimmel is the Executive Director of Trust Across America, the leading source of information, standards and data on trustworthy business.

She is also the self-designated Tribal Chief of The Alliance of Trustworthy Business Experts (#trusttribe)

trustacrossamerica.com/cgi-bin/alliance.cgi

Barbara was recently named one of 25 Women Changing the World 2012

You can follow her on Twitter @BarbaraKimmel and direct comments to

Barbara@trustacrossamerica.com

Recent Comments