Anyone still hesitating to embrace the business notion that trust is an asset – an asset that can leverage real business gains – should look at the ongoing data from Trust Across America (TAA) comparing companies with strong trust profiles to all other companies. TAA is a US-based think tank exploring the issues of corporate trust and the relationship between trustworthy business and company performance in America – this, at a time when we feel corporate trust is not only rare, but also misunderstood and unappreciated as a business-building tool.

Among the empirical data we have collected over three years studying 3,000 US public companies, is the vivid performance of our “Gold 59” – including US brands such as Mattel, United Natural Foods and Accenture. The Gold 59 comprises the US-based public companies that met our minimum benchmarks of trustworthy business behavior – which essentially means an above-average score in each of our five drivers of trust including Financial stability, Accounting Conservativeness, Corporate Integrity, Transparency and Sustainability (FACTS®). While many companies may be strong in multiple drivers, our research shows that a “weak link breaks the chain” and this is why only 59 companies qualified.

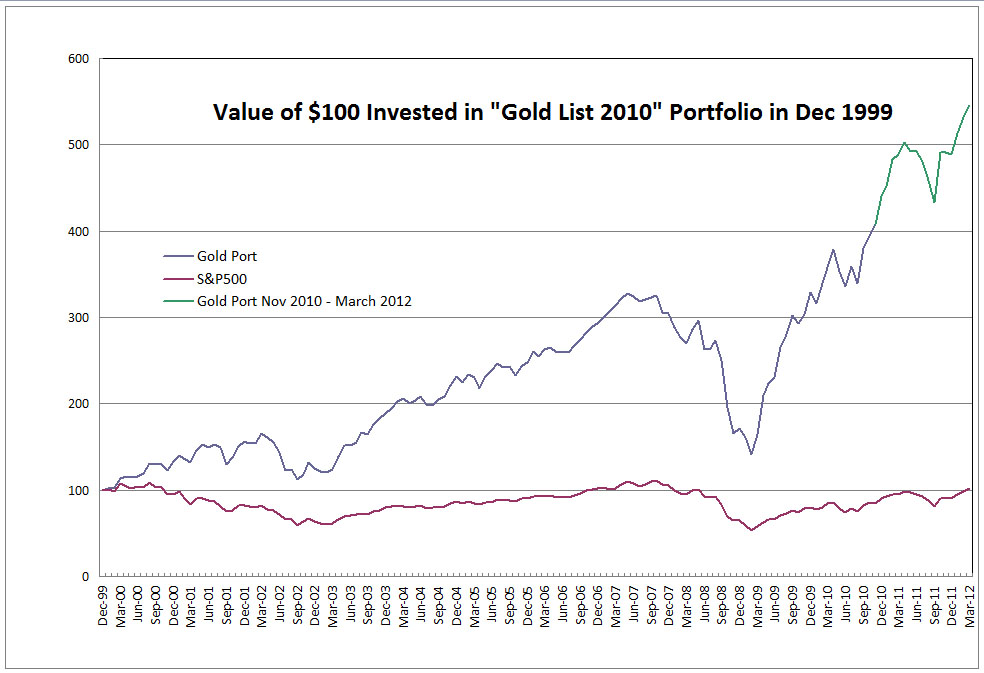

Compared to the S&P Index, an accepted standard for stock performance among some of the largest 500 companies in America, the Gold 59 is presently 500 basis points (or 5%) ahead since November 2010 when TAA began to formally share its data. Certainly the 10-year trend is even more enlightening, compared to a very stagnant S&P.

Source: Trust Across America May 2012

We can point to five critical areas that show why the Gold 59 is so much further ahead of the S&P:

- Governance: Companies that made it into our Gold 59 put transparency and governance high on their priorities lists to ensure they have operations that meet and exceed the minimum standards expected. They are not “just compliant.”

- Stakeholder Engagement: Trust is a tango of at least two, and companies that engaged key stakeholders in meaningful, two-way communication received unbiased high trust marks.

- Consistency: There is nothing like being reliably consistent in delivering on product and service excellence and business performance to solidify trust with the audiences that make a business succeed.

- Authenticity: “Keeping it real” is a motto that rises to the highest levels in business performance, which means being honest about successes, failures, goofs and unexpected triumphs.

- Relevance: Companies that reflect real needs and real opportunities are the companies that attract the highest level of interest and potential for trust dividends by delivering on those high expectations. Sales increase because customers like doing business with trustworthy companies. We see this in other highly ranked FACTS companies like Nike and Starbucks.

“When we deliberately and consistently behave in ways that inspire trust, we will experience high-trust ‘dividends’,” says Stephen M.R. Covey, author of the bestseller The Speed of Trust. “There are actual economics to high trust – the dividends of greater speed and lower cost – just like there are economics to low trust – the “taxes” of lower speed and higher cost. These economics of trust are experienced in relationships, on teams and in organizations, and ultimately these economics translate and extend into the financial marketplace.”

Perhaps the most exciting aspect of trusted companies “beating the street’ is the evidence of the upward virtuous cycle that is created because of the reciprocal nature of trust. When we trust people, they tend to trust us back. When we reward trusting behavior in organizations, it begets more trust-building behavior — which is the essence of a free and civil society. The Gold 59 proves that the market values trustworthy behavior. So why does the crisis of distrust continue and why are companies not running to prove their trustworthiness? This is the inspiration for many more columns on the asset of corporate trust, but it boils down to a system that makes other assets priorities over trust – specifically, antiquated notions of shareholder value and settling for regulatory compliance as the marker of ethical behavior, among other distractions. The value of a company is derived from the relationships it maintains will all its stakeholders, not just shareholders. When we look at corporate performance we can no longer look at the short-term and we cannot merely look at investors.

If we study the other 2,941 pubic companies that don’t meet TAA’s minimum threshold for trustworthy business behavior, we see how rare trust is and how easily poor performance is justified by the apparent fact that “everyone else is doing it.” Trust leadership requires a more progressive stance on building authentic relationships with stakeholders – a relationship that pays trust dividends. It also requires a long-term focus. And for those pioneers in valuing trust and investing in trust, the upside is clear –and the short-term takes care of it self.

Barbara Kimmel, Executive Director of Trust Across America (TAA), a US based think tank and communications program (www.trustacrossamerica.com) whose mission is to restore corporate trust. Email your thoughts and ideas to barbara at trustacrossamerica.com

This is good. Good for business and good for us all.

When I first saw the earlier data (without the data from November 2010 on) I worried about “survivor bias” in the analysis. Did the Gold 59 do better than the S&P because the 59 were all successful enough to survive from 1999 to 2010?

But these new data, taking the 59 and tracing their performance forward, dispels that concern. The new data strengthen the conclusion that trustworthy behavior is good business as well as just plain good.

Not so incidentally, that further analysis demonstrates exactly the kind of analytic integrity and transparency that TAA espouses.

Barbara, you and TAA are performing a great service for us all. Let us hope that the evidence of trustworthy behavior leads more companies to join the Gold list. It’s worth gold to them as well as to we the consumer and shareholder. 🙂

Dear Barbara Kimmel,

“Gold 59″ has become exemplary role model for those companies who do not believe in creating trust. I am sure companies will follow the trustworthy actions, decisions and behaviors. The companies that leverage on trust takes longer time to reap the benefit of trust. The companies that are concerned in short term benefit, might not understand the value of trust. So, companies should make long term analysis of their behaviors on performance.

Today, trust pie in business is very small but continue to increasing due to more evidential tool. I think while making SWOT analysis, companies should make ” Trust, Integrity, Authenticity etc as their first strength. Absence of these nuggets, companies should treat them as lagging in strength and hence try to enhance these parameters.