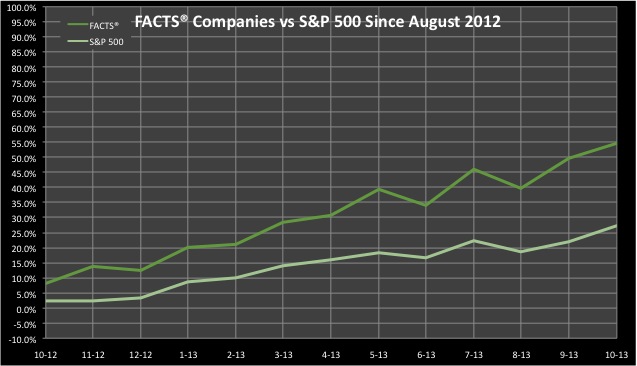

For anyone still hesitating to embrace the business notion that trust is an asset – an asset that can leverage real business gains –look at the ongoing data from Trust Across America – Trust Around the World (TAA-TAW) comparing companies with strong trust profiles to all other companies.

Our portfolio is based on our FACTS model that combines quantifiable indicators of organizational trust including strong Financials, conservative Accounting, good Corporate governance, Transparent business practices and business Sustainability.

Source: Trust Across America November 2013

The market clearly values trustworthy business behavior, so why does the crisis of distrust continue, and why are companies not more focused on trustworthiness? It boils down to a system that makes other assets priorities over trust – specifically, antiquated notions of shareholder value and settling for regulatory compliance as the marker of ethical behavior, among other distractions.

The value of a company is derived from the relationships it maintains will all its stakeholders, not just shareholders. When we look at corporate performance we can no longer look at the short-term and we cannot merely look at investors.

Trust leadership requires a more progressive stance on building authentic relationships with stakeholders – a relationship that pays trust dividends. It also requires a long-term focus. And for those pioneers in valuing trust and investing in trust, the upside is clear –and the short-term takes care of it self.

Barbara Kimmel, Executive Director of Trust Across America (TAA), a US based think tank and communications program (www.trustacrossamerica.com) whose mission is to help build organizational trust. Through it’s Alliance formed in early 2013, global experts are joining forces to collaboratively advance the cause of trustworthy business.

http://trustacrossamerica.com/cgi-bin/alliance.cgi

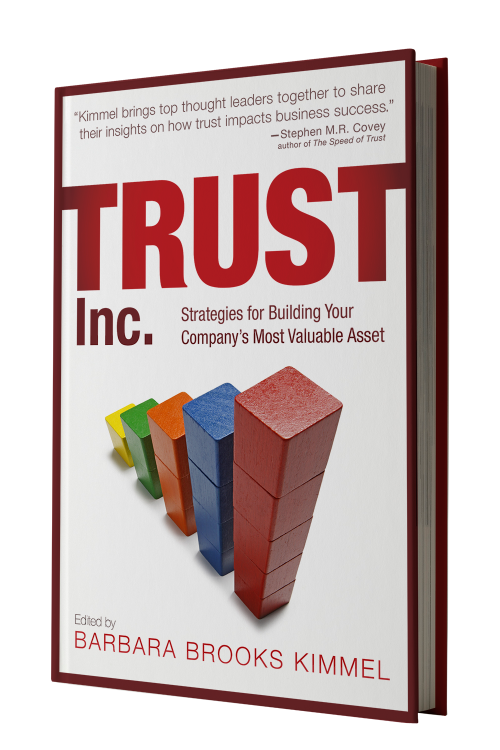

Our new book, Trust Inc., Strategies for Building Your Company’s Most Valuable Asset has just been released.

Recent Comments