Trust weaknesses perhaps represent the greatest risk in today’s competitive business environment. Recent news confirms this.

Trust weaknesses perhaps represent the greatest risk in today’s competitive business environment. Recent news confirms this.

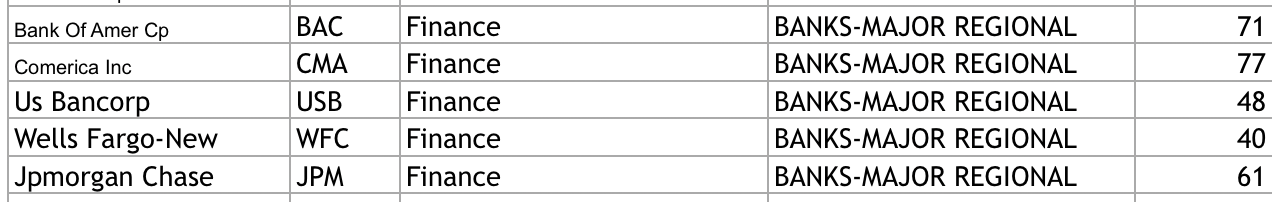

A costly trust “fix” can wreak havoc on a company for years to come. Consider the long-term impact on all stakeholders as a result of Wells Fargo’s trust breach. The fact is, almost every trust “event” can be avoided or “softened” when Boards acknowledge that trust is tangible, and choose to proactively build their trust bank account. Placing trust in the center of the business strategy, and practicing and reinforcing it daily is no longer a nicety, it’s an imperative.

Trust is internal and ALWAYS built from the top down and the inside out.

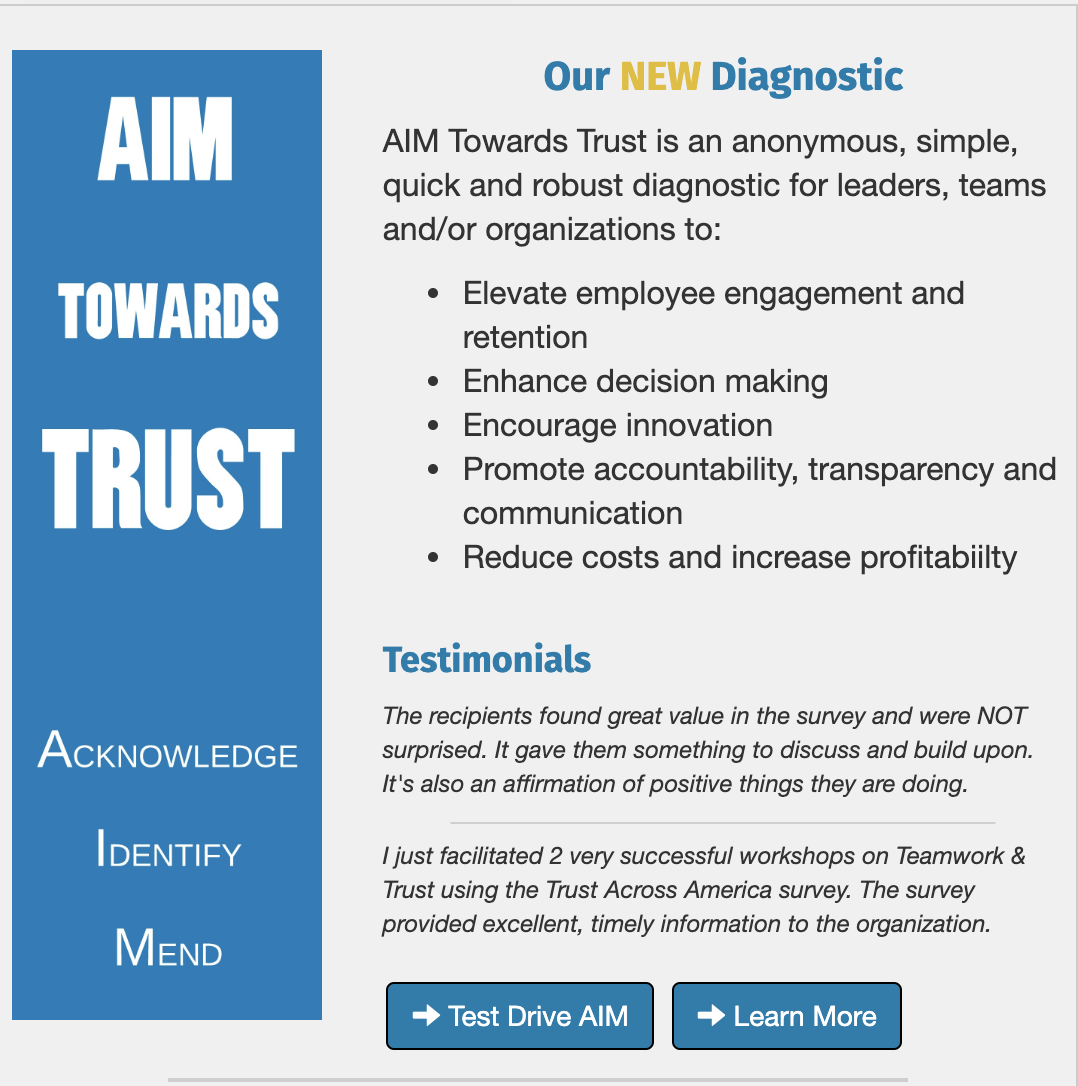

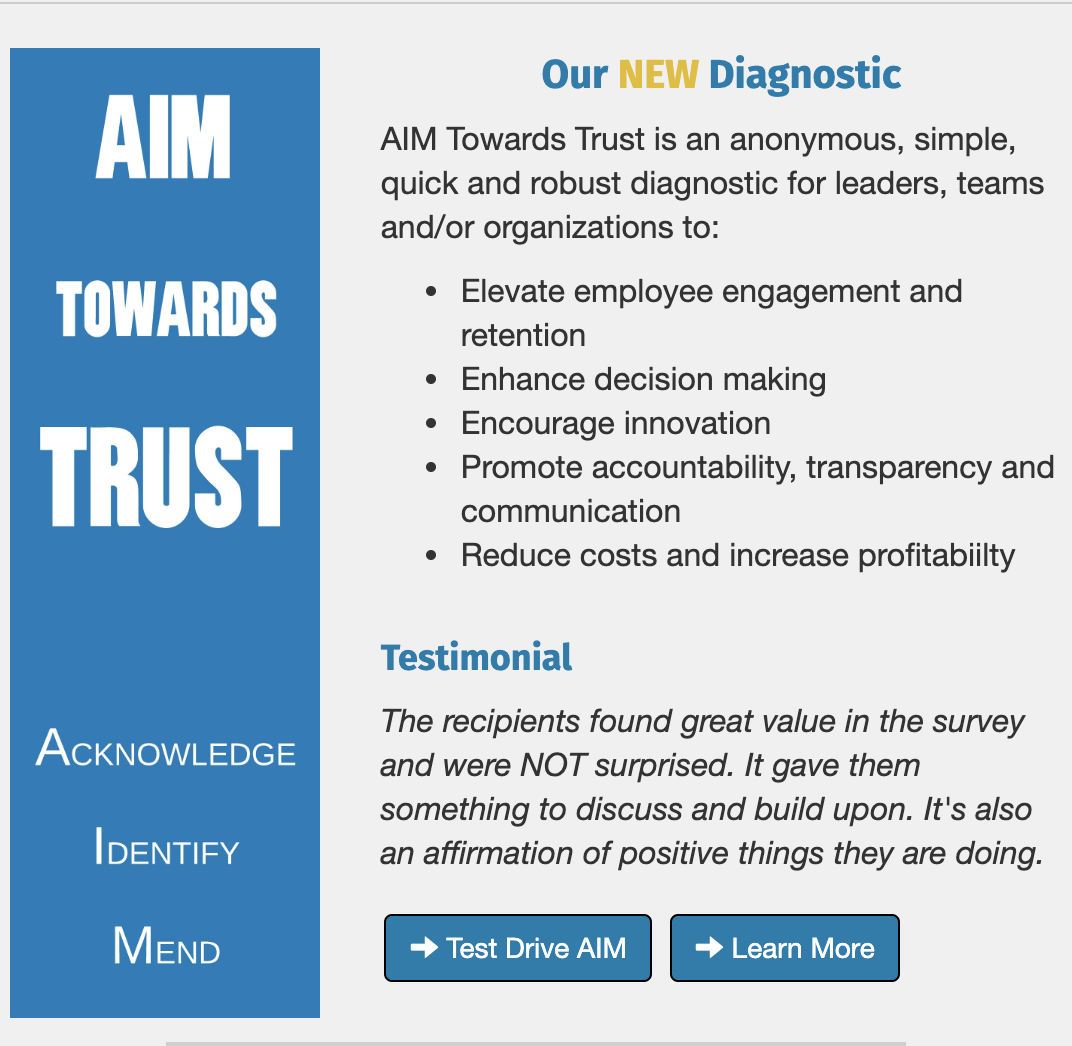

Trust cannot be delegated to PR, communications or any “silo” per se. Purpose, reputation, sustainability and data privacy are also not substitutes for trust. They are simply placeholders or misguided “perception” of trust. A Board that chooses to ignore trust as a stand alone tangible asset, does so at its own risk, and cannot manage it by taking it for granted. Higher organizational trust produces the following outcomes:

- Higher employee engagement and retention and lower fear

- Expeditious decision making

- Innovative mindsets

- Elevated accountability, transparency and communication

- More profitable

Speaking in 2016 at an annual conference of the Arthur W. Page Society, Paul Polman, CEO at Unilever noted that without trust in companies, there can be no genuine prosperity. Seventy-five percent of U.S. graduates, he said, do not want to work for big companies anymore.

Given that trust is always a top down imperative, could the Board of Directors gain valuable insights into the importance of elevating trust if they surveyed their own members based upon universal principles of trust? What would the results reveal? Would the Board find respect to be high or low? How about integrity or understanding?

And what if upon completion of the survey and creation of a plan to address the weaknesses, the Board expanded their trust-building efforts by administering the same anonymous survey to Legal, Ethics & Compliance, HR, Finance and Marketing? Would this provide the Board with any actionable insights? Could reputation risk be reduced? And what would each team’s results look like? How quickly could trust, and the resulting long-term benefits, be elevated by correcting the deficiencies?

In fact, what if a Board member assumed the role of Chief Trust Officer for the entire organization? Sounds like a fairytale? It’s not. This exact exercise is already being implemented in several progressive Boardrooms in both domestic and international organizations.

What are Boards finding?

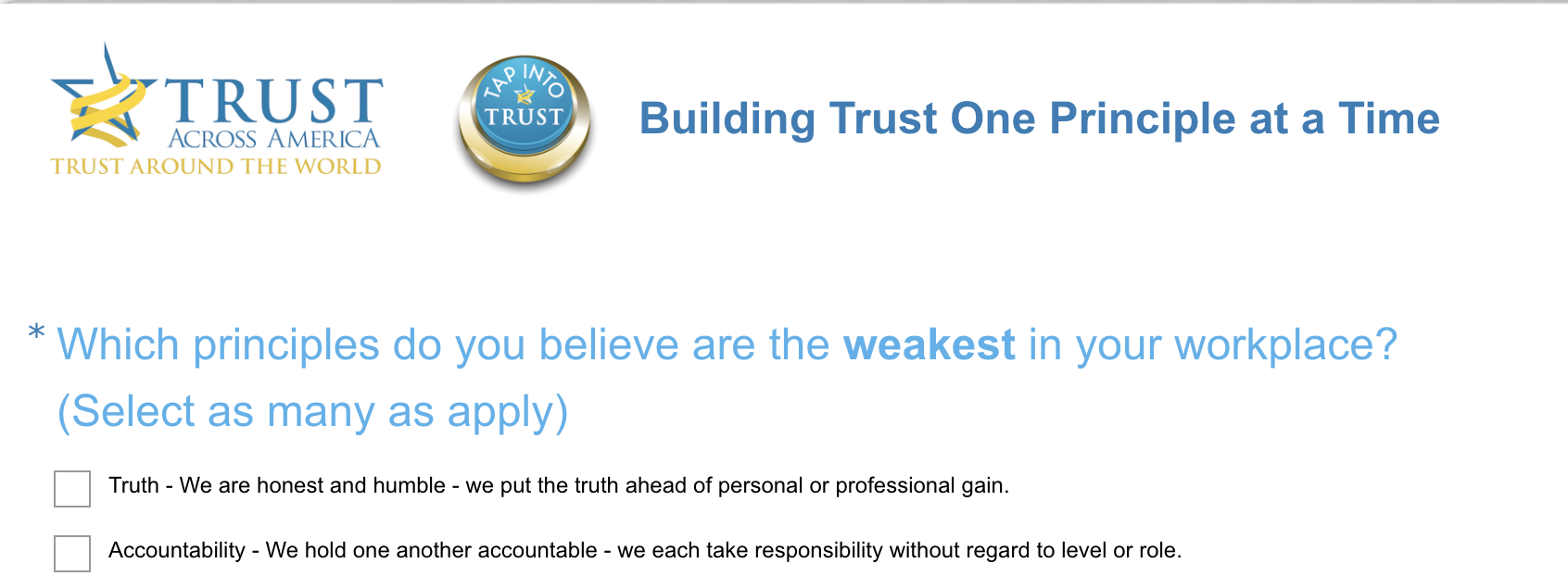

After completing the survey, one Board determined that the Principles of accountability, transparency and tracking were sorely lacking among their members. These weaknesses are now being addressed, while successes such as “truth” and “respect” are being celebrated. This Board plans to roll the diagnostic out firm wide.

A Simple Solution

In 2017, Trust Across America-Trust Around the World’s global Trust Alliance set out to create universal trust-building Principles that could be applied in any team or organization of any size. The plan was to develop a non-threatening mechanism to start the “trust discussion.” The Alliance itself (now in its 6th year) is comprised of cross functional professionals including Board and C-Suite members, compliance & ethics, risk, HR, marketing, finance, accounting, CSR professionals, etc.

Beginning with almost ninety ideas, and over the course of a full year, members weighed in through a powerful decision-making software tool, and honed the ideas to twelve Principles that form the acronym, “TAP INTO TRUST.”

TAP (Trust Alliance Principles) was first published in April 2018 and is currently available as a free PDF download in 16 languages. In just one year, over 50,000 global professionals have “tapped in” and the trust “movement” shows no sign of slowing.

In March 2019, Phase II was introduced. AIM Towards Trust is an anonymous one question, one minute survey that allows teams and organizations to obtain their trust baseline metrics and address weaknesses. AIM is an acronym for Acknowledge, Identify, Mend.

Building trust-based principles into the DNA of an organization lowers fear and elevates security among all stakeholder groups. For example:

- Employees stop looking over their shoulders and instead start engaging, innovating, collaborating and working for the “greater good.”

- Customers no longer question whether the “brand” can be trusted.

- Shareholders trust that their investment is less risky.

The most enlightened Boards (we have written extensively about this subject in TRUST! Magazine) have an enormous business advantage when they choose to become the catalyst that turns around low trust in their respective companies, and in the broader business landscape. The tools are available for those who want to do more than “talk” and to actually make “Trust the New Currency” instead of just the latest buzz. And remember, trust always starts at the top.

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World , now in its 11th year, and whose mission is to help organizations build trust. She also runs the world’s largest global Trust Alliance and is the editor of the award winning TRUST INC. book series. She holds a BA in International Affairs and an MBA.

Purchase our books at this link

Purchase our books at this link

Recent Comments