Why does corporate America continue to turn a deaf ear when profitability need not be sacrificed in the name of trust?

The daily headlines are packed with stories about ongoing distrust in business, and rarely do we see indications that the tide is shifting. Perhaps it’s because business leaders continue to question the relationship between trust and profitability. We’ve aggregated recent data in this article, thereby making The Case for Trust more difficult to ignore.

The Hard Costs of Low Trust

- Gallup’s research (2011) places 71% percent of U.S. workers as either not engaged or actively disengaged.

- The price tag of disengagement (Gallup) is $350 billion a year. That roughly approximates the annual combined revenue of Apple, General Motors and General Electric.

- The Washington Post reported that “the federal government imposed an estimated $216 billion in regulatory costs on the economy (in 2012), nearly double its previous record.”

- The cost of the tort litigation system alone in the United States is over $250 billion. – or 2% of GDP (Forbes, January 2012)

- The six biggest U.S. banks, led by JP Morgan Chase & Co. and Bank of America Corp. have piled up $103 billion in legal costs since the financial crisis (Bloomberg, August 2013)

- According to The Economist Intelligence Unit (2010), 84% of senior leaders say disengaged employees are considered one of the biggest threats facing their business. However, only 12% of them reported doing anything about this problem.

- According to Edelman globally, 50% of consumers trust businesses, but just 18% trust business leadership.

- And finally, in the United States, the statistics are similar, but the story is a bit worse for leadership. While 50% of U.S. consumers trust businesses, just 15% trust business leadership.

This trust gap negatively impacts a company’s revenue, market share, brand reputation, employee engagement and turnover, stock price, and bottom line profitability.

The Low Cost of Hard Trust

Building a trustworthy business will improve a company’s profitability and organizational sustainability.

A growing body of evidence shows increasing correlation between trustworthiness and superior financial performance. Over the past decade, a series of qualitative and quantitative studies have built a strong case for senior business leaders to place building trust among stakeholders high on their priority list. While none of these studies are perfect, over the next decade their results will be increasingly difficult to ignore.

In a Harvard Business School working paper from July 2013 called The Impact of Corporate Sustainability on Organizational Processes and Performance, Robert G. Eccles, Ioannis Ioannou, and George Serafeim provide evidence that High Sustainability companies (those integrating both environmental and social issues) significantly outperform their counterparts over the long-term, both in terms of stock market as well as accounting performance.

According to Fortune’s “100 Best Companies to Work For”, based on Great Place to Work Employee Surveys, best companies experience as much as 50% less turnover and Great Workplaces perform more than 2X better than the general market (Source: Russell Investment Group)

Forbes and GMI Ratings have produced the “Most Trustworthy Companies” list for the past six years. They examine over 8,000 firms traded on U.S. stock exchanges using forensic accounting measures. The conclusions they draw are:

- “… the cost of capital of the most trustworthy companies is lower …”

- “… outperform their peers over the long run …”

- “… their risk of negative events is minimized …”

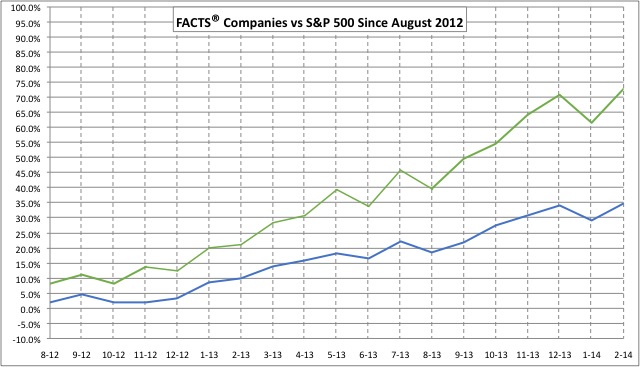

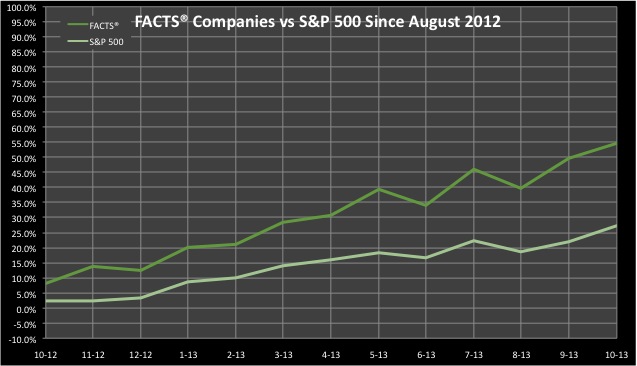

FACTS®. After years of reviewing such studies and vetting independent data providers, Trust Across America – Trust Around the World (TAA-TAW) has been blending five indicators of trustworthy business in its unique FACTS® Framework: Financial Stability, Accounting Integrity, Corporate Governance, Transparency, and Sustainability

The FACTS monthly (rebalanced) portfolio of 25 trustworthy companies significantly outperformed the S&P 500 index (64.3% vs. 30.9% from August 2012 through November 2013).

Numerous indirect indicators of trust also show a direct correlation to superior financial performance.

From Deutsche Bank:

- 100% concurrence on Lower Cost of Capital

(“… academic studies agree that companies with high ratings for CSR (corporate social responsibility) and ESG (environment, social responsibility, governance) factors have a lower cost of capital in terms of debt (loans and bonds) and equity.”)

- 89% concurrence on Superior Market Performance

(“,,,studies indicate companies with high ratings for ESG factors outperform market-based indices”)

- 85% concurrence on Greater Performance on Accounting –Based Standards

(“… studies reveal these types of company’s consistently outperform their rivals on accounting-based criteria.”)

From Global Alliance for Banking on Values, which compared values-based and sustainable banks to their big-bank rivals and found:

- 7% higher Return on Equity for values-based banks

(7.1% ROE compared to 6.6% for big banks).

- 51% higher Return On Assets for sustainable banks

(.50% average ROA for sustainable banks compared to big bank earning 0.33%)

These studies are bolstered by analyses from dozens of other respected sources including the American Association of Individual Investors, the Dutch University of Maastricht, Erasmus University, and Harvard Business Review.

Business leaders may choose to continue to challenge the business case for trust but the evidence is mounting. There is not only a business case but also a financial case for trust. Trust works.

Barbara Brooks Kimmel is Cofounder and Executive Director of Trust Across America –Trust Around the World and editor of Trust Inc. Strategies for Building Your Company’s Most Valuable Asset. In 2012 Barbara was named one of “25 Women who are Changing the World” by Good Business International. For more information, please contact: mailto:Barbara@trustacrossamerica.com

Copyright © 2014 Next Decade, Inc.

Would you like to help us build our Case for Trust? Enter our Case for Trust Challenge!

Recent Comments