If your work brings you in contact with others, and chances are it does, how much time do you, your team or your leaders spend discussing how your internal and external stakeholders perceive the company’s integrity? How much time is allocated to reinforcing the notion that strong corporate culture built on trust and integrity are business imperatives? If your answer is “little to none” you are not alone. As a former CEO told me, most leaders are too busy putting out the day-to-day fires to think much about “soft skills” like integrity. One need only refer to the latest Wells Fargo and Mylan scandals to see what happens when culture, trust & integrity are of little importance to corporate leadership. Ironically, many of these same crises could be averted if the “soft skills” were a business imperative.Why does organizational integrity matter? Can, and should it be measured?

Why do organizational trust and integrity matter?

When the culture and core values of an organization are not only strong but also reinforced daily, and leaders keep their word, the following occurs:

- Employees are more engaged and turnover decreases

- Innovation increases

- Decisions are made faster

- The reputation “bank account” grows

- Crises diminish

- Profits are higher

According to a 2011 Booz & Co. study, “The Global Innovation 1000: Why Culture is Key,” companies with both highly aligned cultures and highly aligned innovation strategies have 30 percent higher enterprise value growth and 17 percent higher profit growth than companies with low degrees of alignment.

A 2013 study by Guiso, Sapienza and Zingales called “The Value of Corporate Culture” finds that proclaimed values appear irrelevant. Yet, when employees perceive top managers as trustworthy and ethical, firm’s performance is stronger.

And in the absence of strong core values…

- Volkswagen lost 20% of its stock value after the emissions scandal and Target’s profits fell 34.3% after it’s data breach.

- A study by Murphy, Shrieves and Tibbs called “Determinants of the Stock Price Reaction to Allegations of Corporate Misconduct” finds that allegations of misconduct are accompanied by statistically significant control-firm adjusted declines in reported earnings, increases in stock return variability, and a decline in concordance among analysts’ earnings estimates.”

- In a 2008 study by Karpoff, Lee and Martin called “The Cost to Firm’s of Cooking the Books,” the authors find The penalties imposed on firms through the legal system average only $23.5 million per firm. The penalties imposed by the market, in contrast, are huge.

Can, and should culture, integrity & trust be measured?

Jose Tabuena recently wrote an article for Compliance Week called “To Really Improve Corporate Culture it must be Measurable.” It’s worth a read. The essence of the article is that “good measurement informs uncertain decision-making. And if you measure what matters, you make better decisions.” While corporate culture, core-values, good citizenship, ethics, integrity and trust are commonly believed to be immeasurable intangibles or soft skills, evidence like that provided above point to the fact that these are not only false beliefs, but also that the benefits of ethical cultures far outweigh the costs. Yet most leaders continue to hold fast to the “soft skills” argument because neither they nor their Boards of Directors are thinking about them, being provided with the “right” data and/or because systemic change is:

- Hard work

- Takes time and

- Requires an “all hands on” approach.

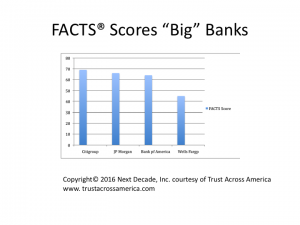

Much of our work at Trust Across America-Trust Around the World focuses on measuring the integrity or trust “worthiness” of pubic companies and identifying “best in breed” via a unique, holistic lens called the FACTS® Framework.

Developed by a cross-silo multidisciplinary team, and in the wake of the financial crisis in 2008, the framework began to take shape by asking the same question of dozens of “siloized” professionals from leadership, compliance and ethics, legal, accounting, finance, HR, consulting, CSR, sustainability, etc. “What do you consider an indicator of corporate integrity or trust “worthiness” that can be independently and quantitatively measured without requiring the input of the organization itself? And while every professional had a different perspective, the same indicators were mentioned time and again. “In order for a company to be trust “worthy” it must display good corporate governance said the governance folks.” Similarly the financial professionals pointed to stable earnings, the accounting group talked about forensics, and so on. And by blending all of these indicators of corporate trustworthiness into a very large integrity spreadsheet, we found ourselves able to measure integrity and trustworthiness with some degree of accuracy. The master spreadsheet also makes glaringly apparent where and why the Enron-like “risk” often lays hidden in these 1500+ public companies.

Fast forward, and with eight years of unique and compelling data, the majority of companies and their leaders continue to hold on to the notion that trust is a soft and immeasurable skill, and that data from one corporate silo to the next need not be viewed as a holistic “whole body” scan. After all, it’s very hard to balance long-term value creation against the need to “maximize earnings” and meet the always-looming quarterly numbers. Better to wait until the next corporate crisis to talk about the importance of trust and how measures will be implemented (maybe) to safeguard against future missteps. Or maybe it’s time to start thinking more carefully about integrity & trust.

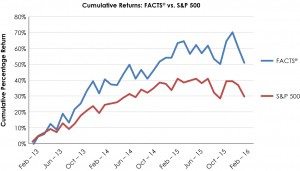

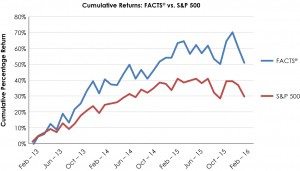

According to our FACTS® Framework, during the three-year period from February 2013-February 2016 America’s most trustworthy public companies substantially outperformed the S&P 500 according to the actual composite audited performance shown below and reprinted with permission of Facts Asset Management, LLC.

This was not a “back test” but rather “live” money under management, followed by an independent audit verifying the returns. Trust works as a business strategy.

FACTS® Managed Accounts were independently audited from Feb.1, 2013-Jan.31, 2016. Prepared by FACTS Asset Management LLC. FACTS® is our model of identifying America’s Most Trustworthy Companies by applying FACTS strategy parameters. The composite results translate to 50.09% for FACTS® and 28.1% for the S&P 500 cumulative percentage return shown above, or 16.7% average annualized for FACTS® vs. 9.5% for the S&P 500 over the same period. The audited Composite Performance results shown above may not be indicative of future results. Full audit documents available upon request.

The composite performance records are based on all accounts managed using the FACTS strategy for a three year period, 2/1/13 to 1/31/16 and are not representative of the FACTS® Asset Management LLC program. Tax consequences are not reflected in the performance records. Past performance is not an indication of future return. There can be no guarantee that a new program will prove to be profitable in the future or that it will achieve performance results similar to those achieved in the past using the FACTS strategy parameters and you may lose money. The performance numbers reflect the reinvestment of dividends. The composite performance net of fees is calculated using a weighted average fee for the entire period because not all accounts were charged equal fees and some accounts were not charged fees. The S&P 500 is a widely recognized market value-weighted index of 500 stocks designed to mimic the overall U.S. equity market’s industry weightings, and does reflect the reinvestment of dividends. Past results are not necessarily indicative of future results.

FACTS® Asset Management LLC is a New Jersey registered Registered Investment Advisor. Prepared by FACTS Asset Management LLC

While no company is perfect, a growing group of visionary leaders have struck that balance and are reaping the rewards shown in the chart above. Over the years our FACTS® Framework has identified many high integrity companies who share above average scores across all measurable indicators of trust “worthiness” and a leadership vision that embraces the new strategic business imperative of elevating integrity & trust.

Leaders that measure what matters, including trust, DO make better decisions and over time they are rewarded with lower risk and higher profitability.

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. Now in its seventh year, the program’s proprietary FACTS® Framework ranks and measures the trustworthiness of over 1500 US public companies on five quantitative indicators of trust. Barbara also runs the world largest global Trust Alliance, is the editor of the award winning TRUST INC. book series and a Managing Member at FACTS® Asset Management, a NJ registered investment advisor.

Copyright © 2016, Next Decade, Inc.

Recent Comments