In its earlier days LinkedIn provided a unique opportunity for professional collaboration, allowing Trust Across America to build an amazing network of likeminded individuals interested in helping organizations build trust. Our Trust Alliance members individually and collectively benefitted by working together on books and contributing to our magazine, engaging in shared learning and development programs (both in person and online), and building a trust framework that has now attracted well over 200,000 global professionals. People can truly achieve extraordinary results when they embrace the power of collaboration, placing it ahead of self interest.

On a personal level, collaboration:

- Improves communication

- Stimulates critical thinking

- Enhances self esteem

- Builds confidence

- Motivates individuals to take risks

- Aids in self-control

- Allows for evaluation of personal values and goals

- Builds empathy

- Promotes better listening

- Develops conflict resolution skills

As a group, collaboration:

- Increases productivity

- Speeds up decision-making

- Encourages creativity

- Simplifies workflows

- Pools skills and resources

- Fosters diversity

- Brings balance to decision-making

- Encourages win/win situations

- And most importantly, builds trust.

Fast forward to 2026. The opportunities for collaboration on LinkedIn seem to have all but disappeared. Its algorithms appear to favor a crowded “garage sale” feel of cheap self promotion and self interest, leaving little to no space for building trust through teamwork. As people become more insular and isolated, as AI chatbots replace teamwork and social media sites place the power of personal relationships in the background, is it any wonder that trust continues to lose its relevance? Trust, after all, is always interpersonal.

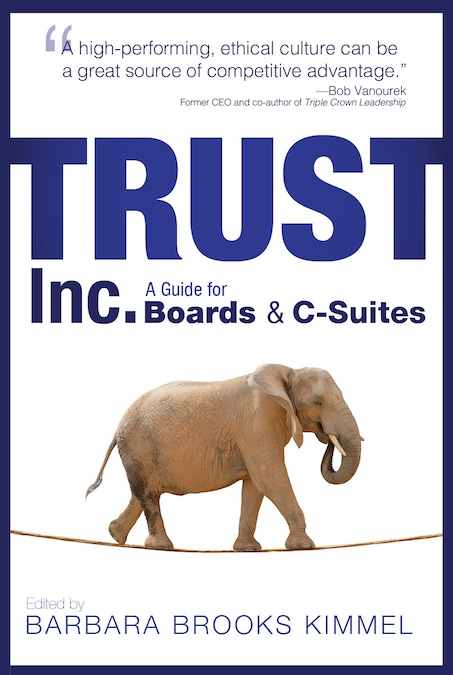

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, The Financial Times, Global Finance Magazine, Bank Director and Forbes, among others.

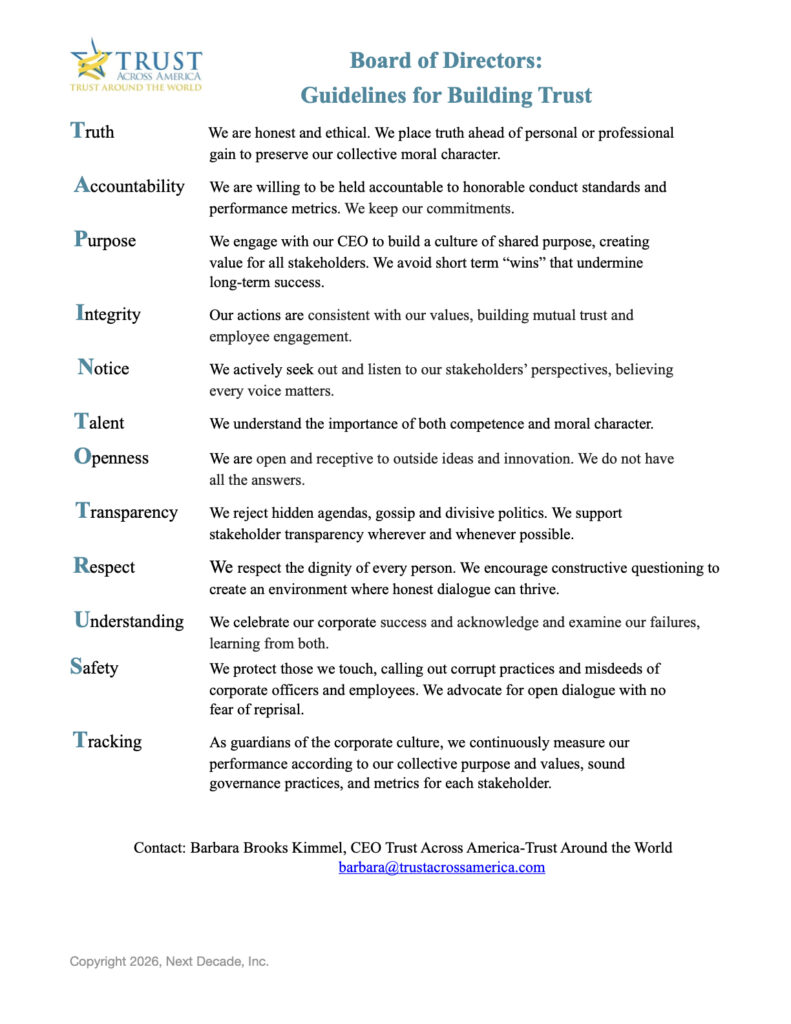

Are you a board member or serve in an advisory capacity to boards?

If board members both individually and collectively are talking about making trust a strategic imperative but not modeling it themselves, how could they expect the organization to be viewed as trustworthy?

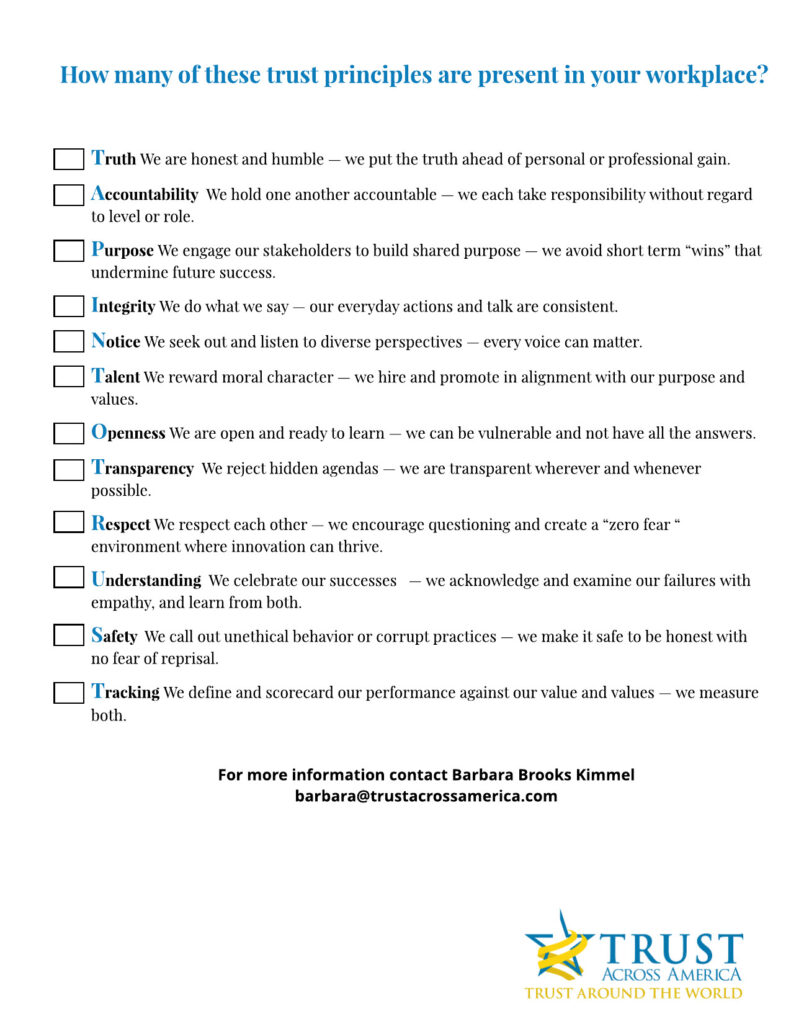

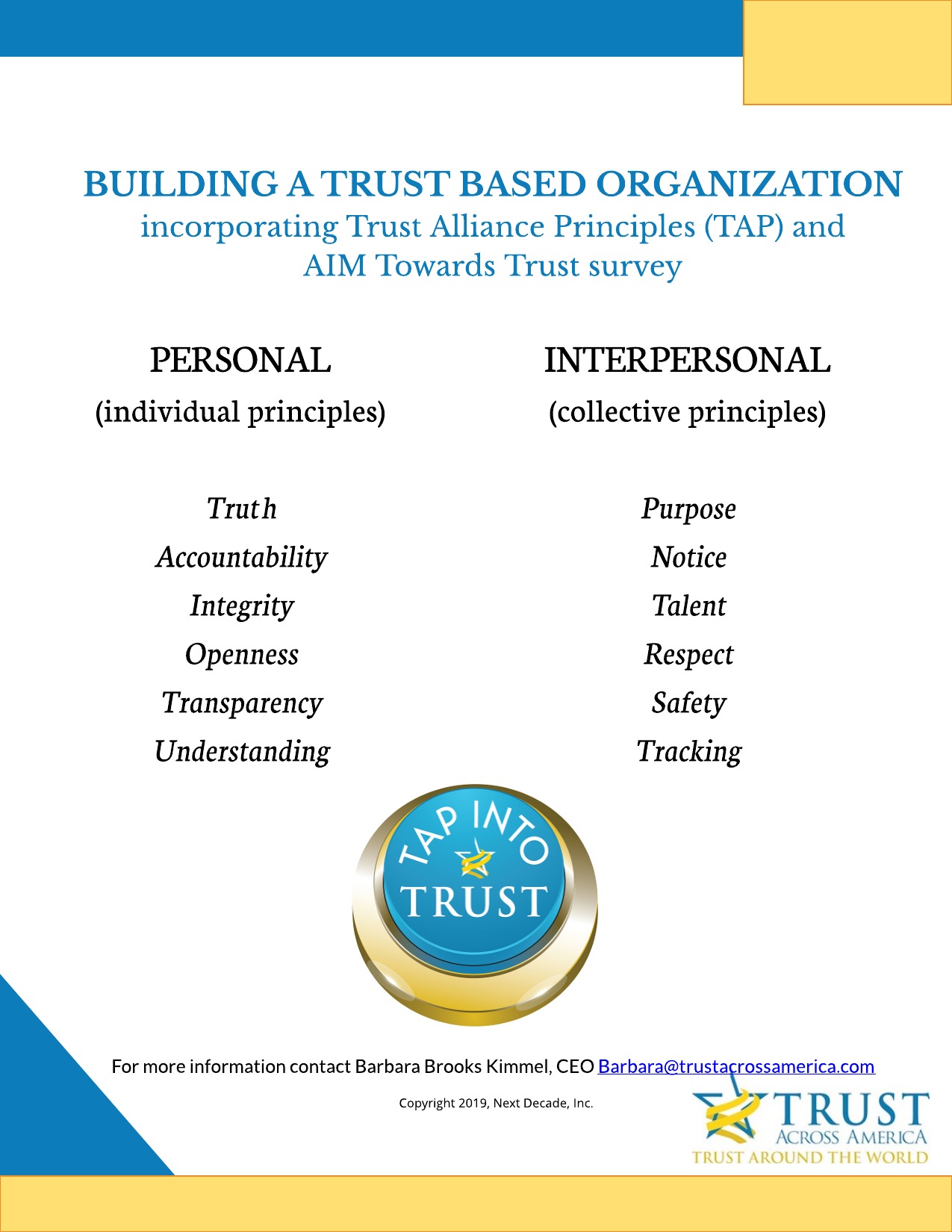

Titles alone do not confer trust. Trust is an intentional strategic imperative that must be practiced and reinforced daily. Using our Tap Into Trust Principles having now been accessed over 200,000 times, the following are our guidelines for Boards of Directors. At a minimum they should be included in every board packet at every board meeting.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, The Financial Times, Global Finance Magazine, Bank Director and Forbes, among others.

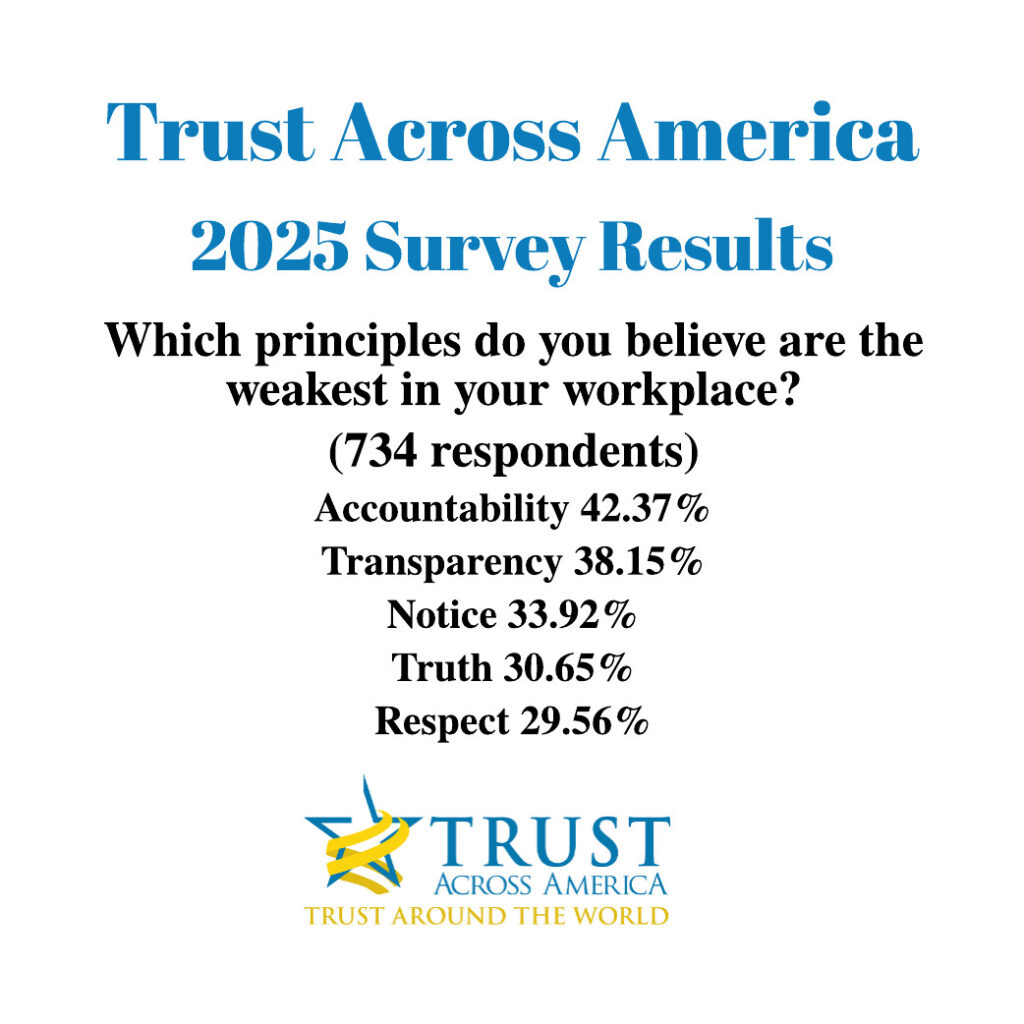

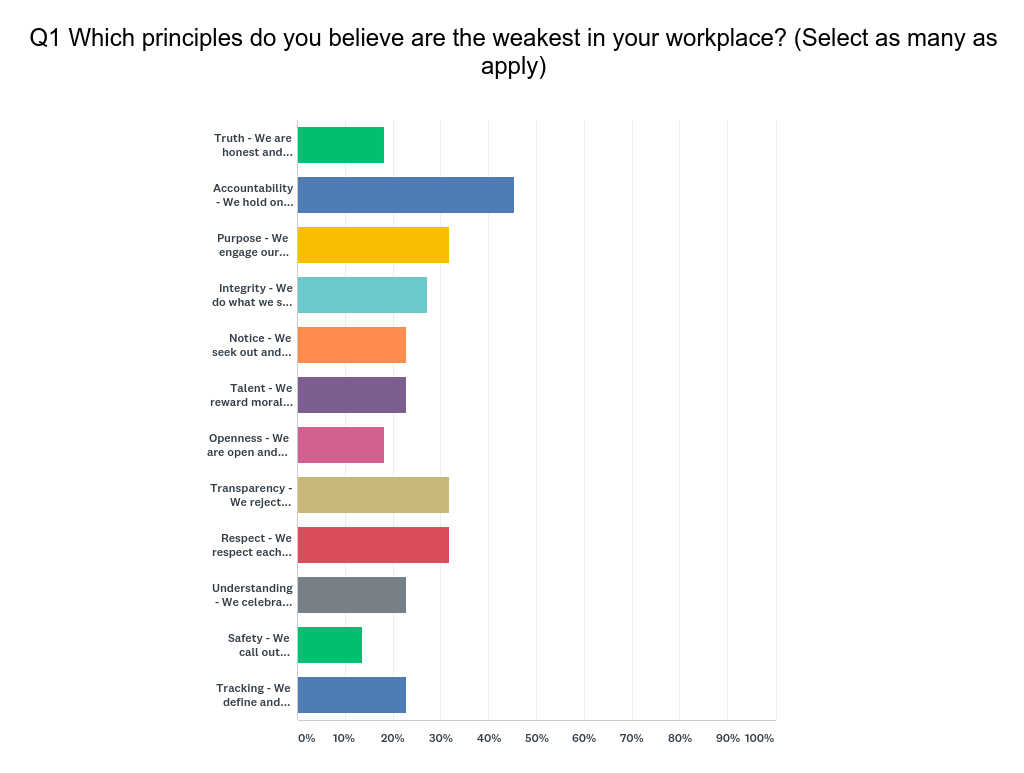

At the end of 2025 we concluded our master survey on Building Workplace Trust and these are the results, showing the weakest behaviors.

What conclusions if any would you draw from this?

If the survey were administered in your workplace would the results look the same?

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

Building a trust based organization begins with tracking trust in teams and addressing trust weaknesses. Doing so results in the following:

Building a trust based organization begins with tracking trust in teams and addressing trust weaknesses. Doing so results in the following:

- Elevating employee engagement & retention

- Reducing workplace stress

- Enhancing decision making

- Increasing innovation

- Improving communication

- Reducing costs and increasing profits

How many readers work on teams and in organizations with these attributes?

The growing interest in our Tap Into Trust campaign has brought over 200,000 individuals to our list of universal principles, available in 16 languages. We are now running the largest global (one minute/one question) anonymous survey on workplace trust, with the goal of determining which of our 12 principles of trust are the WEAKEST in teams and organizations. The anonymous survey can be taken here and the results viewed upon completion.

Building a trust based team or organization first requires leadership ACKNOWLEDGEMENT that trust is a tangible asset, not to be taken for granted, and acknowledgement remains the greatest obstacle, requiring vulnerability. If that hurdle can be overcome, the rest is easy: IDENTIFY and MEND. We call this AIM Towards Trust, and the framework is being adopted by enlightened leaders of teams and in organizations of all sizes and across industries, providing a path forward to high trust.

Elevating trust in teams and organizations requires both personal and interpersonal principles.

The weakest principles break the progress.

Trust does not stop at “talk”. It requires action.

Dress down Fridays, ice cream socials and “purpose” statements will not get a team or organization across the trust goal line.

For more information contact Barbara Brooks Kimmel, Founder, Trust Across America-Trust Around the World

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in The Financial Times, Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

Copyright 2025, Next Decade, inc.

Over the past 15+ years I have spoken with hundreds if not thousands of business leaders from small startups to Fortune 500 and, if the opportunity presents itself, I ask the following question:

What role does trust play in your daily work?

And the most common responses, in no particular order, are:

- I never thought about it

- My employees trust me

- None, I have too many daily fires to extinguish

- None, it’s not my job

- Huge, every year we bring in a “big name” motivational speaker

What’s the message here? Whether you are a leader, manager or work as a member of a team, if you do not intentionally choose to incorporate trust into your daily activities, do not expect it to flourish. It does not happen on its own.

If you are interested in learning more, take a look below.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in The Financial Times, Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

When I was recently asked how trust has changed in the past decade my response was “Not much.” While the people, groups and institutions we should trust keep rearranging themselves in our collective minds, some gain in trust while others fade. Yet according to most major public opinion poll headlines trust has been declining.

But if you think about it, how we experience trust now is the same as it ever was. So is the value of trust – what it does for us – in business, politics, society, and life. Trust is very simply, the outcome of principled behavior. It always has been and always will be. As Stephen Covey has written, “Trust is the foundation for everything we do….” It is part of every relationship we have and undergirds everything we want or need to do together. So it is not that trust has been declining, it is trusting that has declined, and distrusting that has increased.

The Unchanging Experience of Trust

Our bodily experience of trust (and distrust), the sensations we feel, and the underlying neurophysiology that produce them have been with us for millennia. We are hard-wired to trust and to distrust, and we need both. Trusting others allows us to work together to accomplish what none of us can do alone. Distrust is built into our biology to help us stay alive and safe. What we are predisposed to do when we trust or distrust someone, or a group of someones, is also pretty much the same now as when humans were living in small clans and painting on cave walls.

Humans are wired to be drawn towards trust. When we trust others we feel safe enough to be open and at ease with them. At work this translates to collaborating effectively and having fun doing it. We happily share our ideas, good, bad and everything between, with people we trust. When we trust an information source we form opinions and act based on what we hear from them. When we trust a company, we tend to buy from them and invest in them. Distrust, on the other hand, insists we act to protect ourselves. Like a plague, we avoid people, groups, companies, and institutions we don’t trust.

In Whom We Trust (or not)

When you think “I trust this person/group/company/organization” an assessment is being made that their future behavior won’t harm and in fact will support you. That assessment leads to the embodied experience of trust described above, together with feeling certain emotions that travel with trusting, e.g., generosity, curiosity, hope, happiness, care. The same is so with the assessment “I don’t trust” except the sensations and emotions are distinctly different.

Which brings me to what has changed in the past decade and continues to change: specifically who we are trusting, and to what extent we are trusting them to do what they say they will do. According to several recent polls on perception of trust, we are trusting less. For example, over the past decade the Edelman Trust Barometer, an annual global opinion poll of trust levels in business, government, NGOs, and media, has found an annual shift in which of these institutions we are trusting more or less. Similarly public opinion surveys conducted by PwC, Pew Research Center and the Knight Foundation have looked at the trust employees and customers have in companies vs. what company leaders believe, and our trust in science and media, respectively. Again, they find changes in who we are trusting/distrusting.

Couple rotating/decreasing trust in societal institutions with what we know about the outcome of distrusting others and we have the makings of a slow-moving disaster. Unless we start turning this ship around we will see diminishing cooperation with increasing polarization, more balkanization in politics, media and society, and less willingness to talk things out as people pull back from those they distrust.

Trust-Building as Necessary Work

I believe now more than ever it’s time for those of us who work in the field of trust-building, who have the tools and expertise, to focus on helping the people we work with become trust-builders in their chosen fields. We understand that this is a competency that can be learned, developed and practiced. We have frameworks and tools to support people as they try to build their own trust-building capability and capacity. It is incumbent on leaders everywhere to step up and put learning and practicing trust-building at the forefront of their work.

Trusting people at work (where we spend most of our time) and in our communities, and between us and the institutions that hold together the fabric of those communities, is going to be essential for us as a species to make it through the big storms looming on the near horizon: political and social upheaval, and the potential threats posed by AI, to name just a few.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Financial Times, Global Finance Magazine, Bank Director and Forbes, among others.

When taken seriously, tracking and addressing the behaviors that build or weaken trust in teams and organizations will have the following benefits:

- Elevating employee engagement & retention

- Reducing workplace stress

- Enhancing decision making

- Increasing innovation

- Improving communication

- Reducing costs and increasing profitability

Is progress being made?

The growing interest in our Tap Into Trust campaign has brought over 212,000 people to our universal principles, available in 16 languages. We are also running the largest global (one minute/one question) anonymous survey on workplace trust, with the goal of determining which of our 12 principles of trust are the WEAKEST in teams and organizations and whether they change over time. The anonymous survey can be taken here and the results of hundreds of respondents viewed upon completion.

Building a trust based team or organization is not one size fits all. It happens in 3 stages. We use AIM as an acronym for our process.

- ACKNOWLEDGING that trust (the outcome of principled behavior) is a tangible asset

- IDENTIFYING the behaviors that are weakening and strengthening trust

- MENDING the behaviors and tracking them over time

We call this AIM Towards Trust, and the framework is being adopted by enlightened leaders in organizations of all sizes and across industries, providing a path forward to high trust.

Elevating trust in teams and organizations requires specific personal and interpersonal principles and skills.

There is no “one size fits all” or check the box fix.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, The Financial Times, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

For more information contact me here.

Copyright 2025, Next Decade, inc.

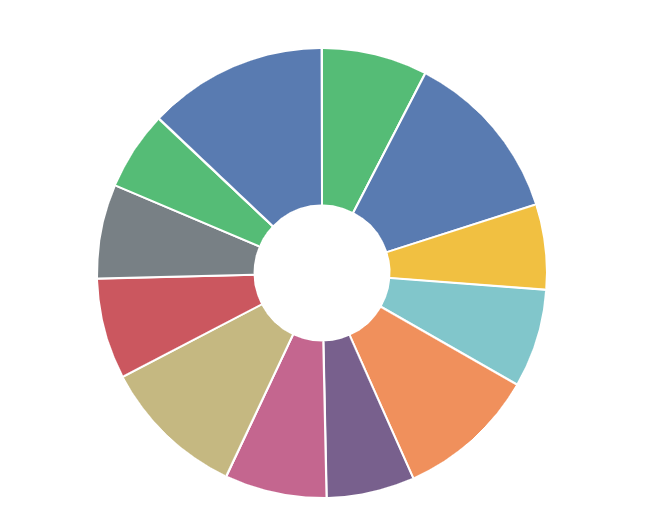

One of our Trust Alliance members was assisting a leadership team in assessing why a certain division was underperforming. We worked with them to run our simple one minute AIM Trust Audit for both the leadership team and the division employees. Take a look at the results. The first chart is leadership (38 respondents) and the second is the division employees. (108 respondents).

A relatively wide gap existed between the leadership team’s perception of the behaviors undermining trust compared to the employee’s perception. These results are quite common in our assessments.

How do you think the leadership team responded when provided with this data?

What would you advise them to do next?

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

For more information visit our website at www.trustacrossamerica.com

Do you, and should you trust the news, especially now? Do you prefer watching Fox over CNN and does it really matter?

As we continue to suffer from Covid fatigue, we now find ourselves further divided by politics, with new details emerging about global news funding and biased reporting. Is there any reason to believe what the media is telling us? In other words, can the media be trusted?

Applying Trust Across America-Trust Around the World’s (TAA-TAW) universal trust principles called TAP reveals some unsettling observations and results.

Take a minute to Answer “Yes” or “No” to each of these questions:

Truth– Does truthful media reporting come before a hidden agenda or monetary gain?

Accountability– Is the media holding itself accountable and taking responsibility regardless of affiliation?

Purpose– Is the media engaging others in building shared purpose to avoid short-term wins?

Integrity– Is the media committed to accuracy in pursuit of the facts?

Notice- Is the media seeking out, listening to and reporting on diverse perspectives?

Talent– Is the media rewarding moral character?

Openness– Is the media open and ready to learn?

Transparency– Is the media rejecting hidden agendas?

Respect– Is the media respectful of each other?

Understanding– Does the media celebrate its successes and also report on its failures?

Safety- Does the media call out all unethical behavior and make it safe to be honest?

Tracking– Does the media scorecard their performance against their values?

What was your “Yes” and “No” answer count?

Can you think of any news media that would score a passing grade of 60% or more?

Can the media be trusted to report the news without bias?

And before you finish reading, substitute the word “media” for “government” or “business” and see if the results change.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

Fifteen plus years have passed since I began studying trust and trustworthiness and building tools to help leaders and teams. My focus remains on companies of all sizes and across industries. Without exception 2024 certainly had its share of organizational trust challenges from data breaches (Ticketmaster, Meta), to product safety violations (Boeing, Kellogg), and toxic workplaces (Nike, Uber) to name just a few.

OUR DATA

- Close to 200,000 global participants have accessed our Trust Alliance Principles, the result of the efforts of some of the worlds leading trust scholars and practitioners. They are available at no cost and in multiple languages on our website at www.trustacrossamerica.com.

- The behavioral trends in our “TAP INTO TRUST” ongoing survey of interpersonal workplace trust have not wavered since we began tracking them in 2019 with over 700 respondents reporting the following:

42% report weak ACCOUNTABILITY

38% report weak TRANSPARENCY

46% report weak TRACKING of trust

In fact, every behavior (12 in total) in our survey shows at least 20% of respondents reporting weaknesses within their organization.

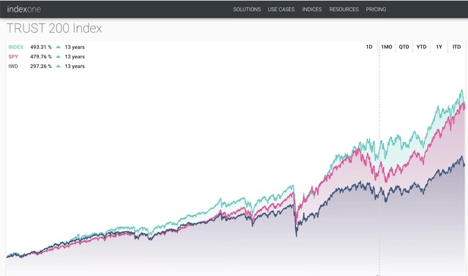

- Our FACTS Framework tracking the trustworthiness of public companies highlights a strong business case for organizations to focus on trust, After 13+ years our Trust 200 Index, maintained by IndexOne continues to outperform the S&P 500.

What will 2025 bring? We gathered some opinions and ideas from some of our trust colleagues in the recently published winter 2025 issue of Trust! Magazine. The link is available on the home page of our website.

Barbara Brooks Kimmel is an award winning author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

Recent Comments