Last week we announced the results of our 4th annual “Most Trustworthy Companies,” ranking almost 2500 US based, publicly traded companies on 5 indicators of trustworthy business behavior. Utilizing our proprietary FACTS Framework, Trust Across America picks up where other lists leave off, analyzing Financial stability, Accounting conservativeness, Corporate governance, Transparency and Sustainability from several independent data sources.

The “Top Ten” companies are shown below.

#1 Manpower Group (MAN), human resource consulting firm

#2 Hormel Foods (HRL), food producer

#3 Jones Lang Lasalle (JLL), commercial real estate

#4 CA Technologies, Inc. (CA), computer software

#5 The Boeing Company (BA), aerospace

#6 CBRE Group (CBG), commercial real estate

#7 Capital One Financial Corporation (COF), bank holding company

#8 The Sherwin Williams Company (SHW), general building materials

#9 Lexmark International, Inc. (LXK), office equipment

#10 Delta Airlines (DAL), transportation

The full press release is reproduced here.

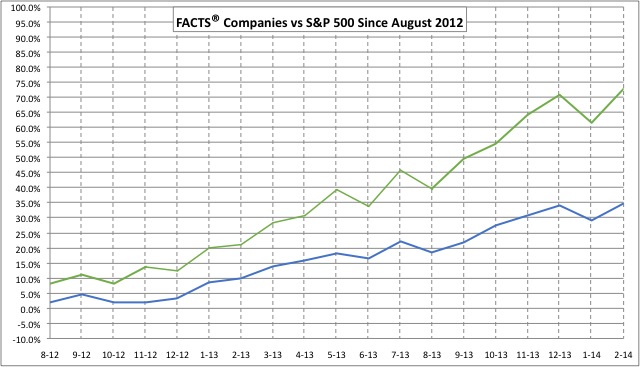

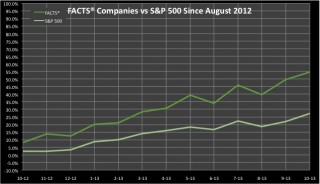

This week we compare the performance of this group to the S&P 500.

Are you surprised about the recent past performance of these companies against the S&P 500? We aren’t. The business case for trust has been proven once again.

One-year return for “Top 10” vs. S&P 500: 38.8% vs. 17.59%, or 120% higher.

Two-year return for “Top 10” vs. S&P 500: 65.74% vs. 33.29%, or 97% higher.

Five-year return for “Top 10” vs. S&P 500: 240% vs. 114.81%, or 109% higher.

*Returns do not include dividends but the yield is similar to the S&P 500.

*While the returns show past performance of the ten companies, a live portfolio being rebalanced monthly has a similar profile.

Investors can choose to support trustworthy companies who are doing business “well” and are also highly profitable. This creates a virtuous cycle whereby less trustworthy companies may be inclined to focus more on corporate culture and less on quarterly returns.

For more information, tools and programs on building trust in your organization, please visit us at Trust Across America.

Recent Comments