Charlie, thank you for participating in our 2020 Trust Insights series. What is your trust insight?

Charlie, thank you for participating in our 2020 Trust Insights series. What is your trust insight?

“Trust” is what happens when a risk-taking trustor meets a virtuous trustee.” Charles H. Green, Trusted Advisor Associates

(The definition is surprisingly important, because it is rarely followed in practice.)

Can you expand a bit on this important insight?

Much talk about ’trust’ is abstract and not practically useful. Change in trust happens only when either someone becomes more willing to trust, or someone else becomes more trustworthy.

We intuitively use personal trust as the paradigm – the strongest form of trust. We describe people as being trustworthy or not – a set of personal virtues, if you will. For example, using the Trust Equation, it breaks down into Credibility, Reliability, and Intimacy: all divided by Self-orientation. A trustworthy person exemplifies these virtues in all their interactions.

The trustor, by contrast, is the one who initiates the trust interaction. They, by definition are taking a risk, putting themselves willfully in the way of some kind of harm through the potentially untrustworthy behavior of the trustee.

The business world is much enamored of ‘measuring’ things; but when it comes to trust, it is largely a fool’s errand. Measuring ’trust’ per se is elusive: most measurements are, and should be, actually metrics of the trustor’s propensity to risk, or of the trustees level of virtuousness.

Can you provide a real life example of a trust “challenge” where your insight has been effectively applied.

- Does such a headline mean that banking has become less trustworthy?

- Or does it mean that people have become less trusting of banks in general?

Charlie, generally, do you think the global “trust” climate is improving or worsening? What actions are making it better or worse?

- A deep-seated business preference for metrics and quantification, including on things that are frankly quite non-measurable

- A fascination with ’scientific’ explanations of trust, including many neuroscientists and Big Data, which have the effect of downgrading traditional, and still valuable, other approaches to the subject

- The de-humanization that comes out of most participation in social media

- The de-humanization that comes out of the very nature of ‘online’ social media participation as a substitute for direct human conduct

Many claim we have a crisis of trust. Do you agree?

Yes.

Charlie, how has your membership in our Trust Alliance benefitted you professionally?

Charlie, thank you so much for your time and more importantly for your commitment to elevating organizational trust. What would you like our audience to know about you?

Charles H. Green is an author, speaker and world expert on trust-based relationships and sales in complex businesses. Founder and CEO of Trusted Advisor Associates, he is author of Trust-based Selling, and co-author of The Trusted Advisor and the Trusted Advisor Fieldbook. He has worked with a wide range of industries and functions globally. Charles spent 20 years in management consulting. He majored in philosophy (Columbia), and has an MBA (Harvard).

A widely sought-after speaker, he has published articles in Harvard Business Review, Directorship Magazine, Management Consulting News, CPA Journal, American Lawyer, Investments and Wealth Monitor, and Commercial Lending Review.

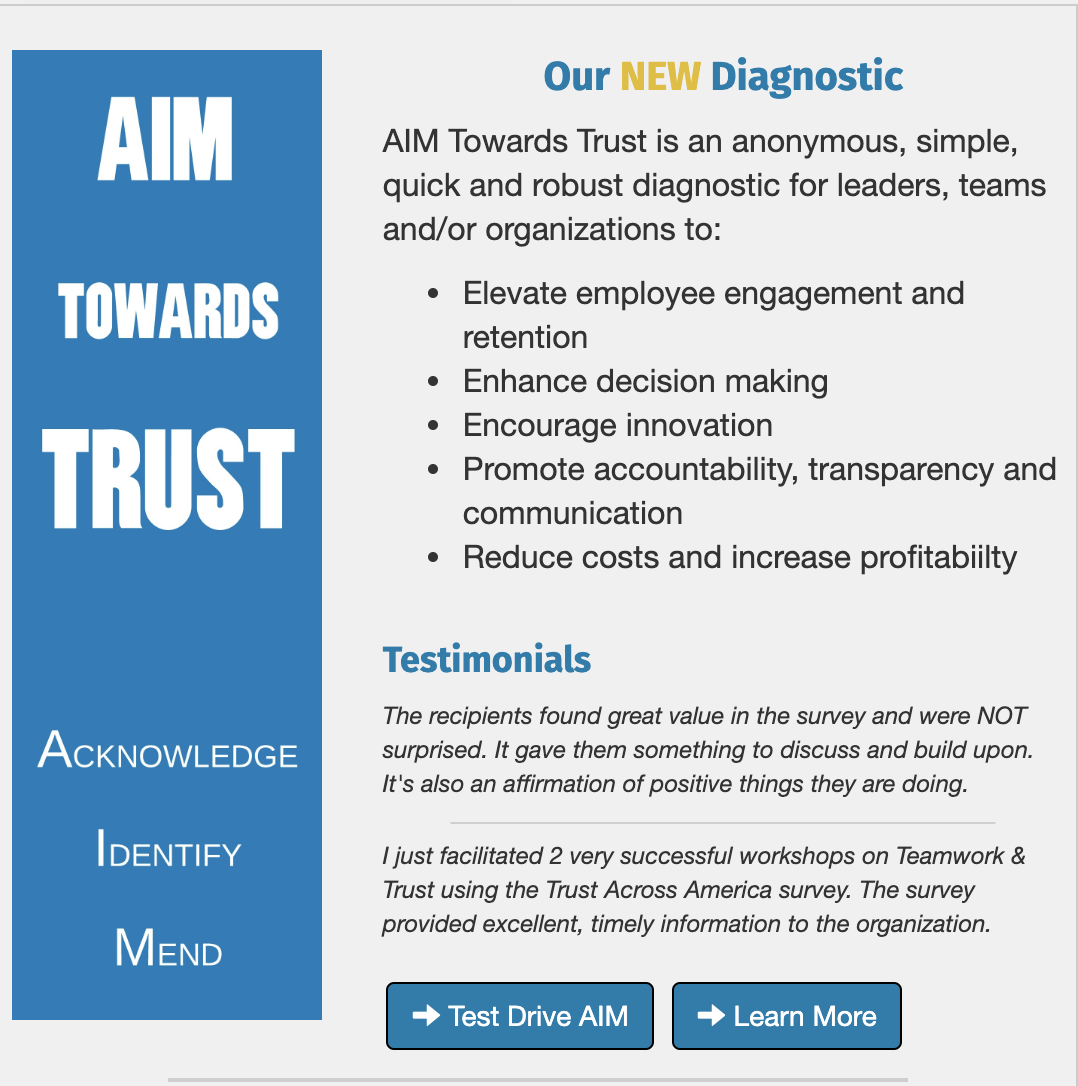

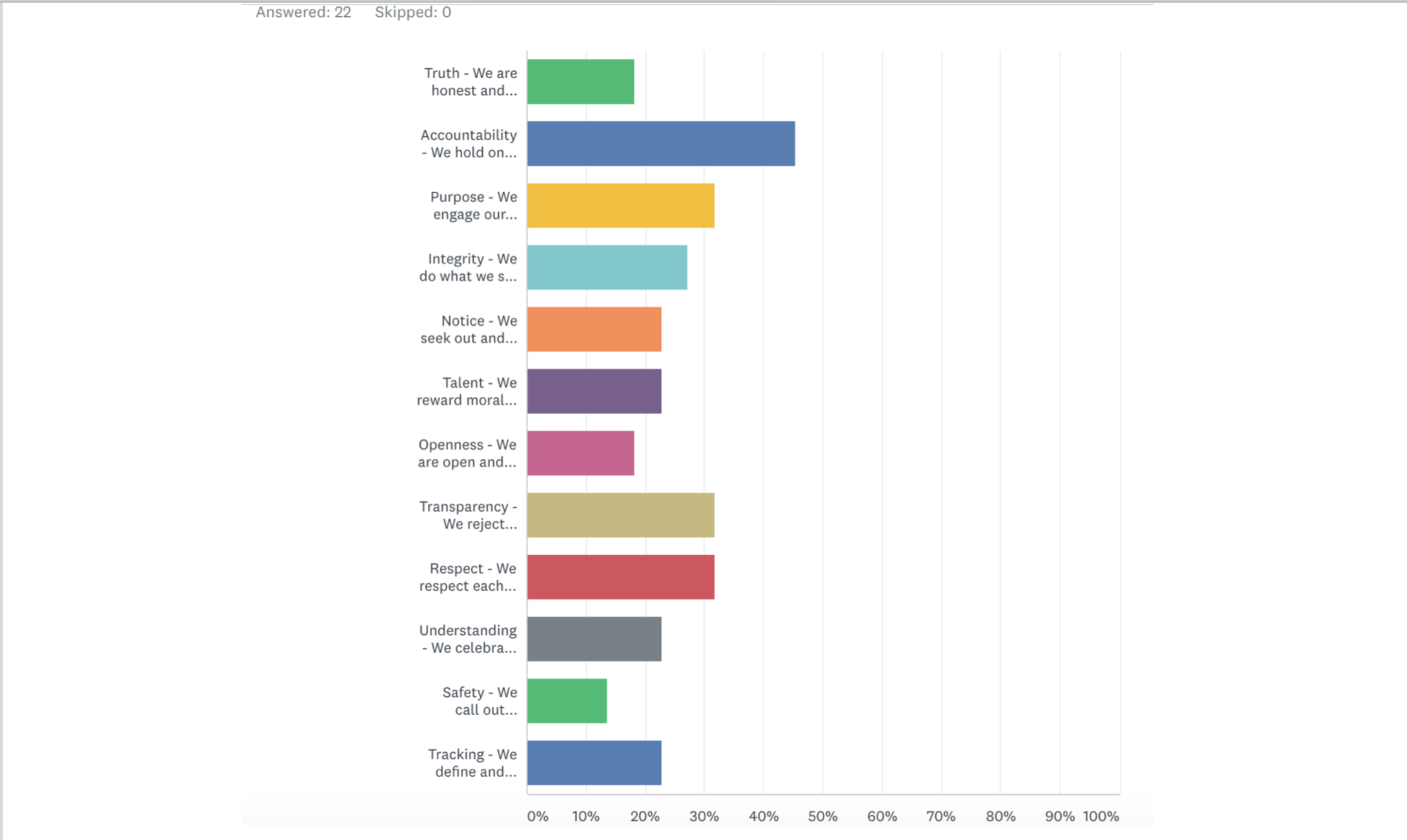

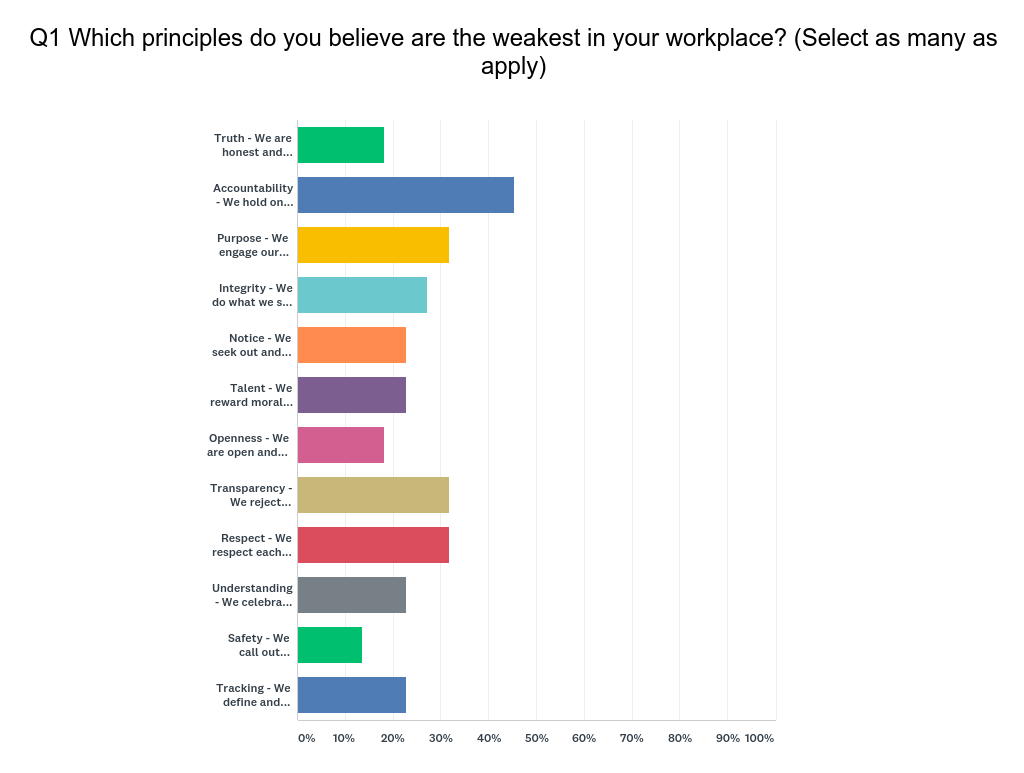

And while you are here, Tap Into Trust and complete our 1 minute/1 question quiz. Find out how the level of trust in your workplace compares to hundreds of others.

Did you miss our previous 2020 insights? Access them at this link.

Contact us for more information on elevating trust on your team or in your organization.

Copyright 2020, Next Decade, Inc.

Recent Comments